Top 5 insurance company stocks with high cash flow from operations: Do you own any?

Financial prowess of the insurance sector with a deep dive into the top 5 companies boasting high cash flow operations

In the realm of insurance, certain companies excel by generating substantial cash from their core operations. These companies, ranging from well-known names to emerging forces, offer valuable insights and perhaps a bit of financial acumen.

Cash flow from operations (CFFO) is a critical metric for assessing a company's financial well-being, indicating how much cash it generates from its primary business activities. In the insurance sector, a high CFFO signifies adept premium collection and claims management, crucial for long-term success.

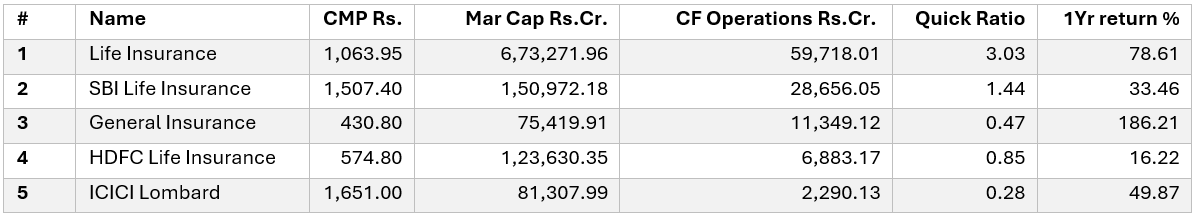

Life Insurance Corporation of India (LIC), the country's largest insurer, leads the pack with a CFFO of Rs 59,718 crore. As a state-owned entity, LIC commands a significant share in the life insurance market, offering a diverse range of products and boasting a robust distribution network.

SBI Life Insurance, a subsidiary of State Bank of India, follows closely with Rs 28,656 crore in CFFO. Leveraging SBI's extensive branch network, it is one of India's fastest-growing insurers, with a burgeoning market share.

General Insurance Corporation of India (GIC), another state-owned giant, offers a wide array of general insurance products and reports a CFFO of Rs 11,349 crore. Its presence in commercial and crop insurance is notable.

HDFC Life Insurance, a collaboration between HDFC and Standard Life, stands out with Rs 6,883 crore in CFFO. With a strong brand and distribution network, it efficiently collects premiums.

ICICI Lombard General Insurance, a subsidiary of ICICI Bank, rounds off the list with a CFFO of Rs 2,290 crore. A key player in retail and corporate insurance, its presence in the market is formidable.

DSIJ offers a service 'Value Pick' with recommendations for long term stock investment based on research and analysis to help subscribers make informed investment decisions. If this interests you, then do download the service details pdf here

Insights gleaned from these companies reveal the dominance of life insurers in India's mature insurance market, with three of the five companies belonging to this sector. While state-owned entities maintain a significant presence, private insurers are rapidly expanding, challenging their dominance.

Disclaimer: The article is for informational purposes only and not investment advice.