SIP of Rs 12,000 in this ETF turned to Rs 5.20 lakhs in just two years; annualized returns of 69 per cent!

Exchange-traded funds (ETFs) have become increasingly popular in India, with a notable surge in interest observed in tier-2 towns.

Exchange-traded funds (ETFs) have become increasingly popular in India, with a notable surge in interest observed in tier-2 towns. Mirae Asset Mutual Fund conducted a survey titled "Decoding ETF Perceptions," revealing that over 60 percent of respondents claimed to possess a solid understanding of ETF products. Among the various ETF categories, Large-Cap and Mid-Cap-based ETFs emerged as the most favored, with a preference for investment periods ranging from 1 to 3 years.

The survey findings indicated that investors are drawn to ETFs with the expectation of generating market returns and outperforming active mutual funds. This preference for ETFs is driven by a desire for optimal investment outcomes and a recognition of the potential benefits associated with these funds.

In this article, we will focus on the CPSE ETF—an open-ended index scheme listed on the exchanges in the form of an ETF, tracking the Nifty CPSE Index. The primary investment objective of this scheme is to closely correspond to the total returns of the Nifty CPSE Index by investing in the constituent securities in the same proportion as the index. However, it's important to note that the scheme's performance may deviate from the underlying index due to tracking error, and there is no guarantee that the investment objective will be achieved.

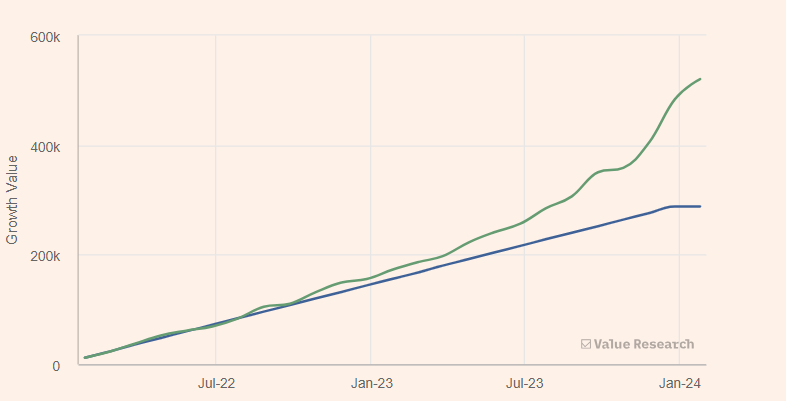

As of January 25, 2024, the CPSE ETF NAV stands at Rs 71.28. An illustrative scenario demonstrates the potential returns, where a monthly SIP of Rs 12,000 over two years would have grown to Rs 5,20,410, reflecting an impressive annualized return of 69.06 percent. In essence, an investment of Rs 2,88,000 made over two years would have appreciated to Rs 5,20,410. This highlights the potential wealth creation offered by CPSE ETFs, making them an attractive option for investors seeking robust returns.

| |

Returns over tume in % |

| Fund Name |

YTD |

6M |

1Y |

3Y |

| CPSE ETF |

6.75 |

55.28 |

84.13 |

52.52 |

| S&P BSE PSU TRI |

6.52 |

48.45 |

74.47 |

48 |

| Equity: Thematic-PSU |

5.93 |

44.94 |

70.04 |

43.55 |

Disclaimer: The article is for informational purposes only and not investment advice