SIP Calculators Exposed: Why They Can't Be Trusted

SIP returns: A modest 5.34 per cent can outperform a 7 per cent return when viewed from a different perspective.

Systematic Investment Plans (SIPs) have gained popularity among investors for their potential to build long-term wealth. However, understanding the intricacies of SIP calculations is crucial, as a seemingly higher annual return may not always lead to greater wealth accumulation in absolute terms. In this article, we'll explore the fascinating world of SIP returns and illustrate how a modest annual return of 5.34 per cent can outperform a 7 per cent return when viewed from a different perspective.

The Annual Returns Paradox

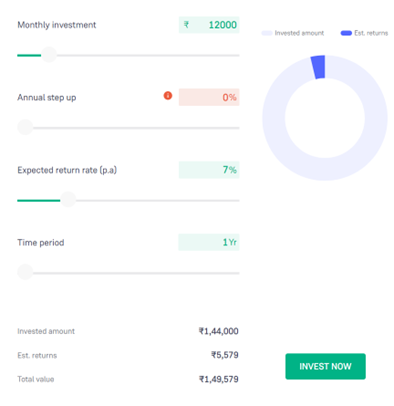

SIP Calculator (Monthly SIP: Rs 12,000 @7 per cent p.a., 1Y)

Source: Groww

As demonstrated with an assumed rate of 7 per cent, your total investment value reaches Rs 1,49,579. Now, let's examine the same SIP amount with FY22 NIFTY returns.

DSIJ’s 'multibagger Pick’ service recommends well researched multibagger stocks with High Returns potential. If this interests you, do download the service details here.

In FY22, NIFTY delivered an approximate average return of 5.34 per cent, lower than the assumed 7 per cent. However, in reality, our total investment corpus still grew significantly.

Factors Behind Return Variations

The interplay between the initial investment amount and the fund's performance at a specific point in time is the key driver of return variations in SIPs.

SIP #7: A Game-Changing Moment

Take SIP #7 in the table, for instance. In that month, NIFTY delivered an impressive 8.73 per cent return with an initial base of Rs 78,477, significantly boosting the overall investment.

The Unpredictability of Timing and Principal

It's crucial to recognize that market timing can't be guaranteed, and the principal base in SIP can fluctuate at specific points in time.

The Impact of Negative Returns

Had SIP #7 experienced a -8.73 per cent return, the losses on the investment would have been substantial. This underscores the importance of managing risks in SIP investments.

Dynamic Scenarios

Late-Year Market Surge:

A late-year market surge can lead to significant growth for SIP investors with a higher initial investment base, thanks to the compounding effect.

Early-Year Market Success:

Exceptional early-year market performance can benefit SIP investors, even with a lower initial investment base, highlighting the role of timing and early momentum.

Bearish Market Challenges:

In a bearish market throughout the year, SIP investments may yield negative returns, emphasizing the need for risk management and diversification.

Year-Long Bull Market:

An extended bull market allows SIP investors to enjoy substantial gains through the compounding effect and consistent investment, leading to impressive long-term wealth growth.

Disclaimer: The article is for informational purposes only and not investment advice.