Multibagger Gaming Stock Surges 3.96 per cent on Rs 982 Crore Investment in PokerBaazi Parent Moonshine Technology

Nazara acquired a 47.7 per cent stake in Moonshine Technology

Shares of Nazara Technologies rose by 3.96 per cent today after the gaming and sports media giant announced a substantial Rs 982 crore investment in Moonshine Technology, the parent company of India's leading online poker platform, PokerBaazi. The strategic move bolsters Nazara's presence in the fast-growing online gaming space, sending positive signals to the market.

As part of the deal, Nazara acquired a 47.7 per cent stake in Moonshine Technology for Rs 832 crore through a secondary transaction. Additionally, the company will infuse Rs 150 crore in primary capital through compulsory convertible preference shares, driving Moonshine’s growth and operational expansion.

PokerBaazi: The Driving Force

PokerBaazi, which drives over 85 per cent of Moonshine Technology’s revenue, is a dominant player in India’s online poker segment, boasting 340,000 monthly active users as of May 2024. The platform’s rapid growth and strong user engagement make it a critical asset in Nazara’s expanding gaming portfolio. Moonshine's fantasy sports platform, SportsBaazi, contributes another 12 per cent of its revenue.

Nazara’s investment is expected to accelerate Moonshine's leadership position in the online poker and gaming ecosystem, a market that continues to see a surge in user participation and innovation.

Nazara’s Growing Dominance

This latest move follows Nazara’s acquisition of UK-based gaming studio Fusebox Games last month for Rs 228 crore, enhancing its international presence. Nazara’s portfolio includes leading esports platform NODWIN Gaming and sports media brands Sportskeeda and Pro Football Network. The company also operates gamified learning platforms like Kiddopia and popular casual games such as World Cricket Championship (WCC).

With the PokerBaazi investment, Nazara is positioning itself as a dominant force in the online gaming industry, diversifying across sectors such as esports, gamified learning, and mobile gaming.

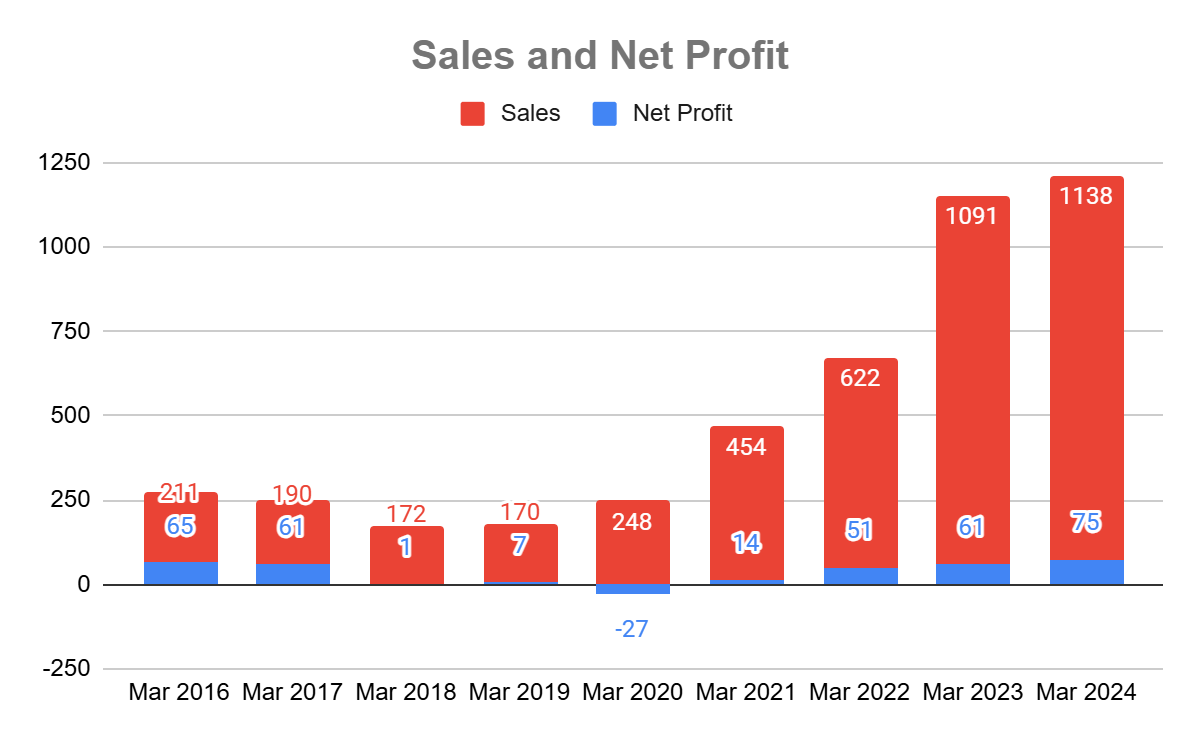

Financials of company:

The company’s sales have grown at a CAGR of 23.4% over the last eight years, while its net profit has grown at a CAGR of 1.8%. With its recent acquisition, the company is expected to continue its upward trend in financial performance. Currently, the company's P/E ratio stands at 94.2.

Stock Performance:

In the last five months, Nazara Technologies’ stock has delivered an impressive return of 77.5 per cent to its investors, with a noticeable rise in trading volumes during this period. Today, the stock is trading at three times its 30-day average volume, reflecting strong investor interest.

DSIJ offers a service 'multibagger Pick" with recommendations for multibagger stocks based on research and analysis to help subscribers make informed investment decisions. If this interests you, then do download the service details pdf here

As of 11:30 a.m. today, Nazara Technologies has reached a market capitalization of INR 7,861 crore, with the stock currently trading at Rs 1,029. The recent surge in price and volume is due to the company's strategic investments in Moonshine technology.

Today’s stock surge reflects the market’s confidence in Nazara’s aggressive expansion strategy, as the company solidifies its position in India’s thriving online gaming and esports landscape.

Disclaimer: The article is for informational purposes only and not investment advice.