Active Infrastructure IPO opened for subscription: Company has order book Rs 345 crore

The IPO proceeds of Active Infrastructures will be used for multiple strategic purposes.

Active Infrastructures Limited Incorporated in 2007 is a civil construction company. The company specialises in infrastructure development and commercial project construction.

Key Segments of Active Infrastructure

Company operates primarily in two key segments: Infrastructure and Construction of Commercial Projects. Within the Infrastructure segment, the company focuses on construction of roads (including bridges), flyovers, water supply systems, irrigation projects, and other related infrastructure activities and in the construction of commercial projects segment, the company focuses on creating commercial spaces that meet evolving business and consumer needs. Key projects like RIAAN Tower offer modern, sustainable environments, supporting business growth and community engagement.

Company operates on a pan–India scale with projects being in Maharashtra, Madhya Pradesh, Uttar Pradesh and Tripura .

Key IPO Highlights

Active Infrastructures IPO is a book built issue of Rs 77.83 crores. There is no offer for sale in the IPO, the issue is entirely a fresh issue. The price band for the Active Infrastructures IPO is fixed between Rs 178 and Rs 181 per share. Retail investors need to apply for a minimum of 600 shares, which comes to Rs 1,06,800 at the lower end. At the higher price band end, it comes to Rs 1,08,600. For HNIs, the minimum application is 2 lots (1,200 shares), requiring an investment of Rs 2,17,200.

Active Infrastructures IPO will be listed on NSE SME with a tentative listing date fixed as Friday, March 28, 2025. The issue allocation: Retail shares offered 47.5 per cent, 3.81 per cent is allotted to QIB, 37.98 per cent to NII (HNIs), Anchor Investor offered 5.69 per cent and Market Makers shares offered 5.02 per cent.

How the IPO Funds Will Be Utilised

The IPO proceeds of Active Infrastructures will be used for multiple strategic purposes. A major portion, approximately Rs 38.98 crore, will be allocated towards meeting the company’s working capital needs. Around Rs 16.72 crore will be used for repaying or prepaying certain borrowings and maintaining margin money for bank guarantees. Additionally, Rs 7.05 crore is planned for capital expenditure towards the purchase of construction equipment. The remaining funds will be used for general corporate purposes. In short, the funds will help strengthen the company’s financial position by supporting working capital, reducing debt, and investing in key capital assets.

|

Sr. No.

|

Particulars

|

Estimated Amount (Rs in Crore)

|

|

1

|

Funding Working Capital Requirements of Company

|

38.9804

|

|

2

|

Repayment/ Prepayment of Certain Borrowings availed by our Company and Margin Money for obtaining Bank Guarantee

|

16.7234

|

|

3

|

Capital expenditure towards purchase of construction equipments

|

7.048

|

|

4

|

General Corporate Purpose#

|

|

#The amount utilized for general corporate purpose shall not exceed 25% of the gross proceeds of the Fresh Issue

Financial Performance

|

Particulars

|

H1FY25 ended September 30, 2024

|

March 2024

|

March 2023

|

March 2022

|

|

Revenue from Operations (Rs in crore)

|

33.6712

|

97.1833

|

89.3983

|

1.1008

|

|

Other Income (Rs in crore)

|

0.2272

|

0.2472

|

0.1889

|

0.0046

|

|

Total Income (Rs in crore)

|

33.8985

|

97.4306

|

89.5872

|

1.1055

|

|

EBITDA (Rs in crore)

|

8.1657

|

17.3308

|

13.0633

|

0.1073

|

|

PAT (Rs in crore)

|

5.5519

|

10.4455

|

9.8699

|

0.0875

|

|

PAT Margin (%)

|

16.49

|

10.75

|

11.04

|

7.95

|

Figures in Rs crore.

Active Infrastructures has shown robust growth over the past three years. Revenue from operations surged from just Rs 1.10 crore in FY22 to Rs 97.18 crore in FY24, reflecting rapid expansion. Profit After Tax (PAT) also rose significantly from Rs 0.09 crore in FY22 to Rs 10.45 crore in FY24. For the six months ended September 30, 2024 (H1FY25), the company has already reported Rs 33.67 crore in revenue and Rs 5.55 crore in PAT, maintaining a healthy PAT margin of 16.49 per cent.

As per September 2024, the revenue from top 3 clients account for 96 per cent of the total revenue and top 10 clients account for 99 per cent of the revenue. Infrastructure segment accounts for 42 per cent of the revenue and 58 per cent of revenue comes from construction of commercial projects. As per RHP company’s ongoing order book stands at Rs 345 crore.

Management Outlook

As on the date of filling Red Herring Prospectus, the projected revenue of the company 's ongoing highway project with the company's subsidiary Digvijay Shradha Infrastructure Private Limited is Rs 70 Crore up to March 2025.

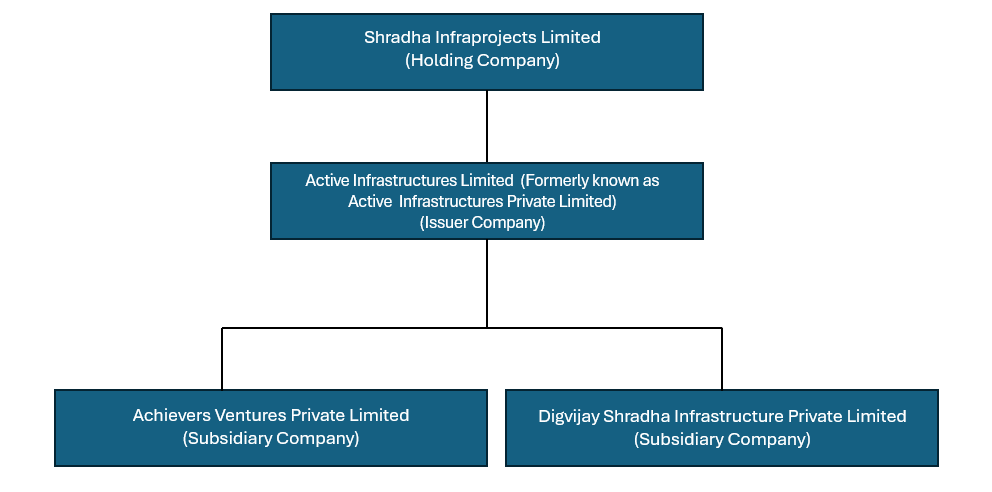

Structure of the Company

Here’s the Shareholding Pattern of Subsidiary Company

Digvijay Shradha Infrastructure Private Ltd

|

Sr. No.

|

Name of Shareholder

|

Number of Shares

|

Holding in %

|

|

1

|

Active Infrastructures Limited (Formerly known as Active Infrastructures Private Limited)

|

50,500

|

50.50%

|

|

2

|

Digvijay Construction Private Limited

|

49,500

|

49.50%

|

| |

Total

|

1,00,000

|

100%

|

Achievers Ventures Private Ltd

|

Sr. No.

|

Name of Shareholder

|

Number of Shares

|

Holding in %

|

|

1

|

Active Infrastructures Limited (Formerly known as Active Infrastructures Private Limited)

|

99,99,999

|

99.99%

|

|

2

|

Shreyas Raisoni jointly with Active Infrastructure Private Limited

|

1

|

0.01%

|

| |

Total

|

1,00,00,000

|

100%

|

Company’s promoters are Mr. Sunil Gyanchand Raisoni, Mr Shreyas Sunil Raisoni, Riaan Diagnostic Private Limited and Shradha Infraprojects Limited.

Disclaimer: The article is for informational purposes only and not investment advice.