Union budget teasers: A glimpse into government's disinvestment targets

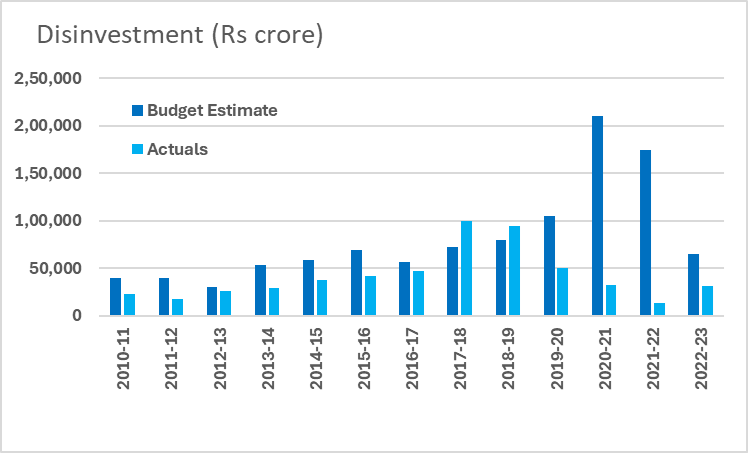

The Union Budget 2023-24 disclosed a disinvestment target of Rs 51,000 crore, marking a notable 21 per cent dip and the lowest in seven years.

Understanding Disinvestment

The disinvestment process involves the government selling its stake in public sector enterprises to strategic or financial buyers, fuelling social and infrastructure projects while curbing fiscal deficits.

Different Approaches:

- Minority Disinvestment: Government retains majority control.

- Majority Divestment: Government hands over control but retains some stake.

- Complete Privatisation: 100 per cent control passes to the buyer.

How It Works: Conducted by the Department of Investment and Public Asset Management (DIPAM), the process aims to manage government investments in public sector enterprises. The National Investment Fund (NIF) was established in 2005 to channelize disinvestment proceeds.

Why Disinvestment Matters

Reduce Fiscal Burden: Disinvestment becomes a fiscal tool, alleviating budget pressures and addressing revenue shortfalls.

Private Sector Encouragement: It fosters private ownership, signalling government commitment to reforms and a conducive business environment.

Boosts Efficiency: By divesting from public sector enterprises, the government enhances efficiency and competitiveness, introducing a more market-oriented approach.

Resource Allocation and Transparency: Resources freed up through disinvestment can be reallocated for social and infrastructure development. Private ownership often brings in greater transparency and accountability.

DSIJ offers a service 'multibagger Pick" with recommendations for multibagger stocks based on research and analysis to help subscribers make informed investment decisions. If this interests you, then do download the service details pdf here

Challenges on the Horizon

Political Sensitivity: Disinvestment is a political hot potato, often facing opposition from parties and trade unions resistant to the sale of public sector enterprises.

Valuation Hurdles: Determining the value of these enterprises can be complex due to bureaucratic structures and non-market-oriented practices.

Labor Concerns: Disinvestment may trigger concerns about job losses and wage cuts among workers.

Buyer Interest and Regulatory Hurdles: Finding buyers, especially for underperforming enterprises, can be challenging. Regulatory and legal processes can further complicate the journey.

What Lies Ahead in FY 2024-25

As the Union Budget 2024 approaches, all eyes are on the disinvestment goals. The challenge lies in revising targets amid the current shortfall, striking a balance between fiscal objectives and strategic disinvestment. The upcoming budget becomes a critical chapter in India's economic story, where challenges and aspirations intersect.