Top 10 IT stocks that doubled in 1 year: #1 soared over 750 per cent!

E2E Networks has outperformed other IT companies, delivering a 793 per cent return over the past year, followed by Network People (390 per cent) and Oracle Financial Services (198 per cent).

The market has shown mixed behavior recently. As of Nov 12, 2024 (11:25 am), benchmark indices remain flat, while the broader market is on the rise. The Q2 earnings season continues, and IT sector results have been released. Let’s examine the top performers over the past year.

We’ll cover each company's overview and profitability metrics

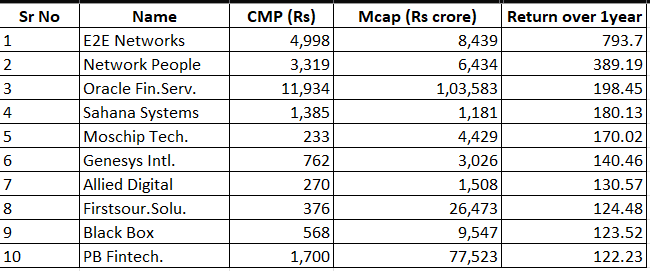

Here are the top 10 IT companies which doubled in this year

(source: screener)

Notably, E2E Networks has outperformed other IT companies, delivering a 793 per cent return over the past year, followed by Network People (390 per cent) and Oracle Financial Services (198 per cent).

What Drove the Share Price?

E2E Networks Ltd

E2E Networks, listed on the NSE, is a hyperscale cloud platform focused on AI, offering advanced cloud GPUs and a robust ecosystem for developing and deploying AI/ML applications.

The company has shown consistent topline growth, with a sales CAGR of 22.5 per cent from FY19 to FY24. During this period, profit expanded by about 11 times, rising from Rs 2 crore in FY19 to Rs 22 crore in FY24.

As a growth-stage company, E2E is not paying dividends but reinvesting in capital expenditures (capex) for future expansion. Capex has steadily increased—from Rs 25 crore in FY22 to Rs 35 crore in FY23 and Rs 185 crore in FY24. The latest Q2FY25 presentation shows capex reaching Rs 107.4 crore in H1FY25.

Profitability is also on an upward trend. The EBITDA margin rose from 44 per cent in FY22 to 51 per cent in FY24 and reached 66 per cent in H1FY25. Similarly, the PAT margin doubled from 12 per cent in FY22 to 23 per cent in FY24, reaching 25 per cent in H1FY25.

DSIJ offers a service 'Flash News Investment' with recommendations for Profit-making Ideas for You (Weekly) based on research and analysis to help subscribers make healthy profits. If this interests you, then do download the service details pdf here

Network People Services Technologies Ltd

Network People Services Technologies acts as a fintech partner, providing software and digital payment solutions to the banking sector, focusing on mobile banking, payment switch solutions (such as IMPS and UPI), and merchant platforms. The company supports clients such as Canara Bank, Kerala Gramin Bank, Karnataka Gramin Bank, IBM India Private Limited, and Cosmos Co-operative Bank, with a monthly transaction volume of Rs 60 crore in FY24.

The stock has returned 389 per cent over the past year. From FY19 to FY24, the company's sales CAGR was approximately 48 per cent, with profit expanding 27 times—from Rs 1 crore in FY19 to Rs 27 crore in FY24.

Growth on a half-yearly basis is significant as well. Revenue increased from Rs 53.3 crore in H1FY24 to Rs 129.11 crore in H1FY25, marking a 142 per cent YoY growth. EBITDA grew by 173 per cent YoY, and net profit tripled from Rs 10.16 crore in H1FY24 to Rs 33.78 crore in H1FY25.

The company is exploring new interoperable payment opportunities, recently launched the AI-driven Evok 3.0 platform, and has implemented AI in Regtech, paving the way for long-term growth.

Oracle Financial Services Software Ltd

Oracle Financial Services provides financial software, custom application development, IT infrastructure management, and outsourcing services for the financial industry.

The stock delivered over 190 per cent in the past year, with a 3-year share price CAGR of 39.5 per cent and a dividend yield of around 2 per cent, increasing total shareholder return.

Oracle Financial Services is a mature company with consistent operating profit margins in the 40 per cent-50 per cent range. Revenue is diversified, with 24 per cent from America, 22 per cent from the Asia Pacific, 20 per cent from the Middle East and Africa, and 11 per cent from India.

The stock’s price-to-earnings ratio (PE) is slightly above the industry average (41 vs. 39), with an impressive return on capital employed (ROCE) of around 40 per cent. The 3-year EPS CAGR of 5.5 per cent is lower than the share price CAGR, suggesting the market’s growing confidence in the company’s value.

In Q2FY25, revenue rose 15.8 per cent YoY to Rs 1,674 crore from Rs 1,444 crore. Profit also grew, reaching Rs 578 crore, up from Rs 417 crore a year earlier.

Do you own any of the above IT stocks into your portfolio? Do let us know in the comment below.

Disclaimer: The article is for informational purposes only and not investment advice.