The surprising consequences of Reliance's dollar debt: What you need to know!

Reliance's 2022-dollar bond issue illustrates the potential risks of foreign currency debt

Indian companies often turn to foreign markets, especially for dollar-denominated bonds, as a means to raise capital. While this avenue can be lucrative, it comes with its own set of risks, particularly regarding currency fluctuations.

Reliance's USD 4 Billion Bond Issue: A Game of Risk In January 2022, Reliance Industries, India's largest company, made waves with its USD 4 billion bond issuance. Despite offering attractive interest rates and diversified maturities, the deal came with hidden risks, especially concerning currency exchange rates.

Bond Breakdown: Reliance's 2022 Offering The bond offering comprised three tranches totaling USD 4 billion, each with its own interest rate and maturity date. The Notes were priced at various points over the respective US Treasuries benchmark.

The Catch: Rupee Depreciation Reliance issued the bonds at an exchange rate of Rs 74 per dollar. However, by February 2024, the rupee had weakened to around Rs 83 per dollar, a 10 per cent depreciation. This shift has significant implications for Reliance's finances.

DSIJ offers a service 'Value Pick' with recommendations for long term stock investment based on research and analysis to help subscribers make informed investment decisions. If this interests you, then do download the service details pdf here

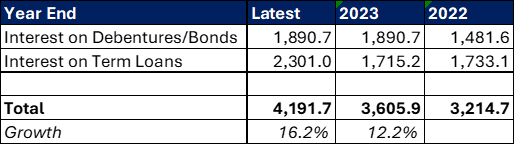

Financial Impact: Rising Repayment Costs The depreciating rupee means that every dollar repayment now costs Reliance 10 per cent more in rupee terms. This hike in finance costs could dent profitability and impact investor confidence.

Currency Hedging: A Costly Shield While currency hedging can offer some protection against exchange rate fluctuations, it comes with its own costs. Companies must weigh the benefits against the premiums paid for hedging.

Lessons Learned: Cautionary Tales for Others Reliance's size may help it weather the storm, but smaller companies could face greater challenges. Even minor currency fluctuations can have a significant impact on their financial stability.

Key Takeaways: Navigating Currency Risks

- Conduct thorough risk assessments before venturing into foreign borrowing.

- Explore different hedging strategies to mitigate currency risks.

- Diversify funding sources to reduce dependence on any single currency or market.

- Maintain transparency with investors and stakeholders regarding currency risks.

While foreign borrowing can be a strategic move, it's crucial to understand and mitigate the risks involved, particularly those related to currency fluctuations.

Disclaimer: The article is for informational purposes only and not investment advice.