Pre-election budget 2024 hits tomorrow - Here's what you need to know!

On February 1, Finance Minister Nirmala Sitharaman's budget speech will reveal a delicate balance of new spending initiatives and a cautious approach to fiscal discipline.

In the hustle and bustle of India's political landscape, Prime Minister Narendra Modi is gearing up for a strategic move—leveraging the country's last budget before the upcoming elections to capture the hearts of voters. Expected on February 1, Finance Minister Nirmala Sitharaman's budget speech will reveal a delicate balance of new spending initiatives and a cautious approach to fiscal discipline.

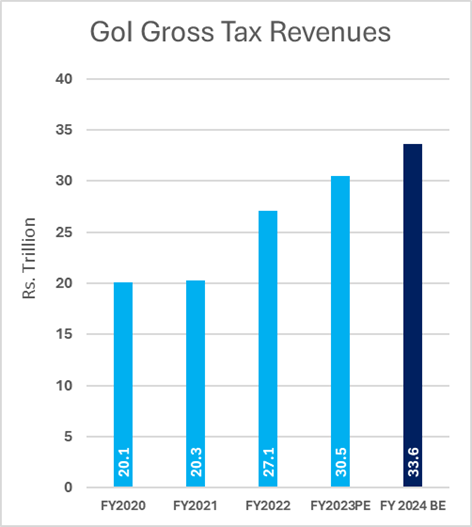

Economic Momentum and Tax Windfall

India's booming economy has not only set the stage for rapid growth but has also bestowed a tax windfall upon the government. This financial boon provides room for Finance Minister Sitharaman to continue infrastructure spending without widening the fiscal deficit.

Priority: Farmers, Women, Poor, and Youth

Ahead of the elections, Modi's government is eyeing key demographics—farmers, women, the poor, and young people. Approximately 40 per cent of the budget will be dedicated to boosting agriculture, rural development, and infrastructure—a strategic investment in the foundational pillars of our nation.

The remaining budgetary allocation will pivot towards impactful measures, encompassing taxation policies, subsidies, and targeted initiatives for the empowerment of youth and women.

Interim Budget with Limited Announcements

This week's budget is an interim one, with Sitharaman already hinting at no major announcements. However, it sets the tone for continuity until a new administration takes office, emphasizing stability and fiscal responsibility.

Robust Growth and Minimal Stimulus

Anticipating a 7 per cent growth in the coming fiscal year, the Finance Ministry sees little need for additional stimulus. With Modi's strong electoral position, populist measures may take a back seat, allowing the government to focus on sustaining economic momentum.

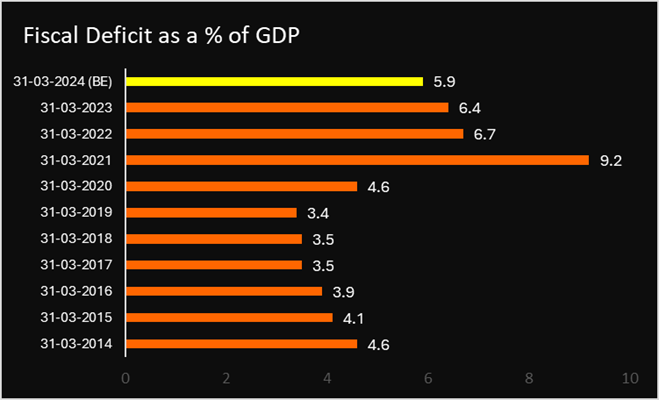

Fiscal Discipline: Deficit Reduction

From a pandemic-induced peak of 9.2 per cent of GDP, the government is steadily reducing the fiscal deficit. The current fiscal year's 5.9 per cent target is likely to be met, with a further reduction to 5.3 per cent projected for the next financial year (FY25-26), aligning with the government's commitment to long-term deficit reduction.

Tax Receipt Surge and Spending Reallocation

A surge in tax receipts, with income tax up by almost 30 per cent and corporate tax and GST showing significant increases, has contributed to deficit reduction. The government's commitment to bringing down the budget deficit to 4.5 per cent is accompanied by strategic spending reallocation toward infrastructure and subsidy control.

Supporting Agriculture and Rural Areas

Expectations are high for increased financial support to farmers, especially after last year's aggressive measures to curb food prices. With poor rainfall affecting crops, the government has already increased subsidies on essential items and extended a free food program, addressing challenges in rural areas where a significant portion of the population resides.

DSIJ offers a service 'Vriddhi Growth' with recommendations for long term stocks to invest for growth based on research and analysis to help subscribers make informed investment decisions. If this interests you, then do download the service details pdf here

Empowering Women Voters

In a bid to woo women voters, Modi's government has amplified cooking gas subsidies and provided cheaper loans. Support measures targeting women in the upcoming budget, recognizing their pivotal role in the elections.

In the grand theatre of Indian politics, the budget unfolds as a carefully orchestrated act. As the curtains rise on February 1, all eyes will be on Sitharaman's budgetary performance—a script that could shape India's economic narrative and political destiny.

Disclaimer: The article is for informational purposes only and not investment advice.