Is it the right time to invest in funds with longer durations?

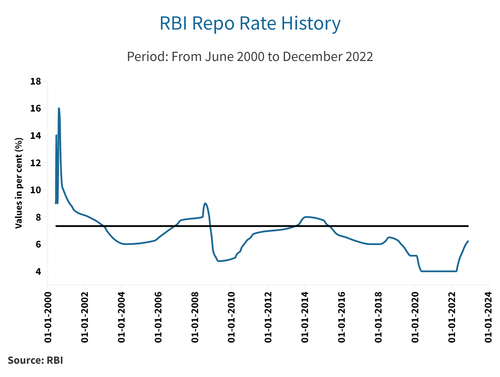

The interest cycle seems to have peaked off and investing in funds with longer durations looks like a good tactical call. So, should you invest in funds with a longer duration? Keep reading.

If you head back to the years 2019 and 2020, Debt Funds were a buzz with double-digit returns. This was particularly true for funds with a long duration such as gilt funds, Gilt funds with 10-year constant maturity and long-duration funds. Such returns can very well be attributed to the falling interest rate scenario. However, this theme lost its charm in 2021 and 2022.

In the last two years, these funds returned even lower than the interest rate on a savings account. This can very well be attributed to key policy rates remaining lower in 2021 and the Reserve Bank of India (RBI) beginning its rate hike journey in 2022. However, it seems like the interest rate cycle is nearing its peak.

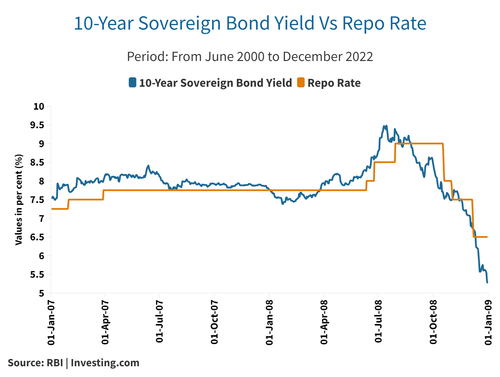

Moreover, it seems that the current market yield has factored in the majority of the upcoming rate hikes. In fact, if we look at the historical data, it looks like interest rates are lagging while bond yields are the leading indicators.

As can be seen in the above graph, the bond yields are forward-looking in nature. This can very well be witnessed from July 2008 to December 2008, wherein bond yields started falling even before the actual fall in the repo rates.

| |

22-May-20

|

07-Dec-22

|

Increase (Basis Points) *

|

|

10-Year Sovereign Bond Yield

|

5.96

|

7.27

|

131

|

|

Repo Rate

|

4.00

|

6.25

|

225

|

|

100 Basis Points = 1 per cent

Source: RBI | Investing.com

|

As can be seen in the above table, the pace of increase in the yields seems to be falling as against the repo rate. This is probably due to the fact that the bond yields are indicating the peak of interest rate cycle.

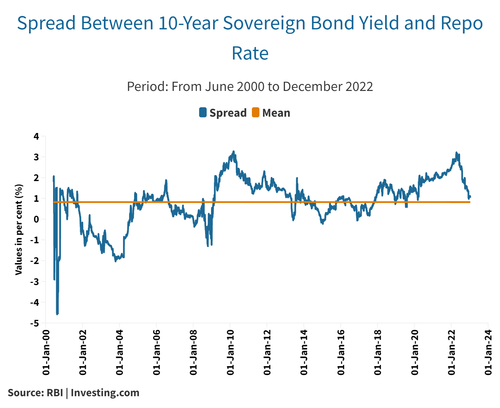

As can be seen in the graph above, the spread between the 10-year sovereign bond yield and repo rate had topped in April 2022 at 3.12 per cent. After that, it started reverting to its historical mean of 0.82 per cent. At present, it is hovering around 1.02 per cent. Historically, after the Global Financial Crisis (GFC) in March 2010, this spread touched an all-time high of 3.27.

Top performing funds with longer duration

In this section, we have listed the top-performing funds with a longer duration with an average maturity of over seven years.

Final Thoughts

As can be seen from the analysis above, it is quite likely that the interest rate cycle is attaining a peak. However, investors need to bear in mind that this does not in any way mean that the key policy rates would start falling in near future. Therefore, investment in funds with longer duration should be a tactical and not a strategic call. Moreover, investing based on your financial goals is the most sensible thing to do.