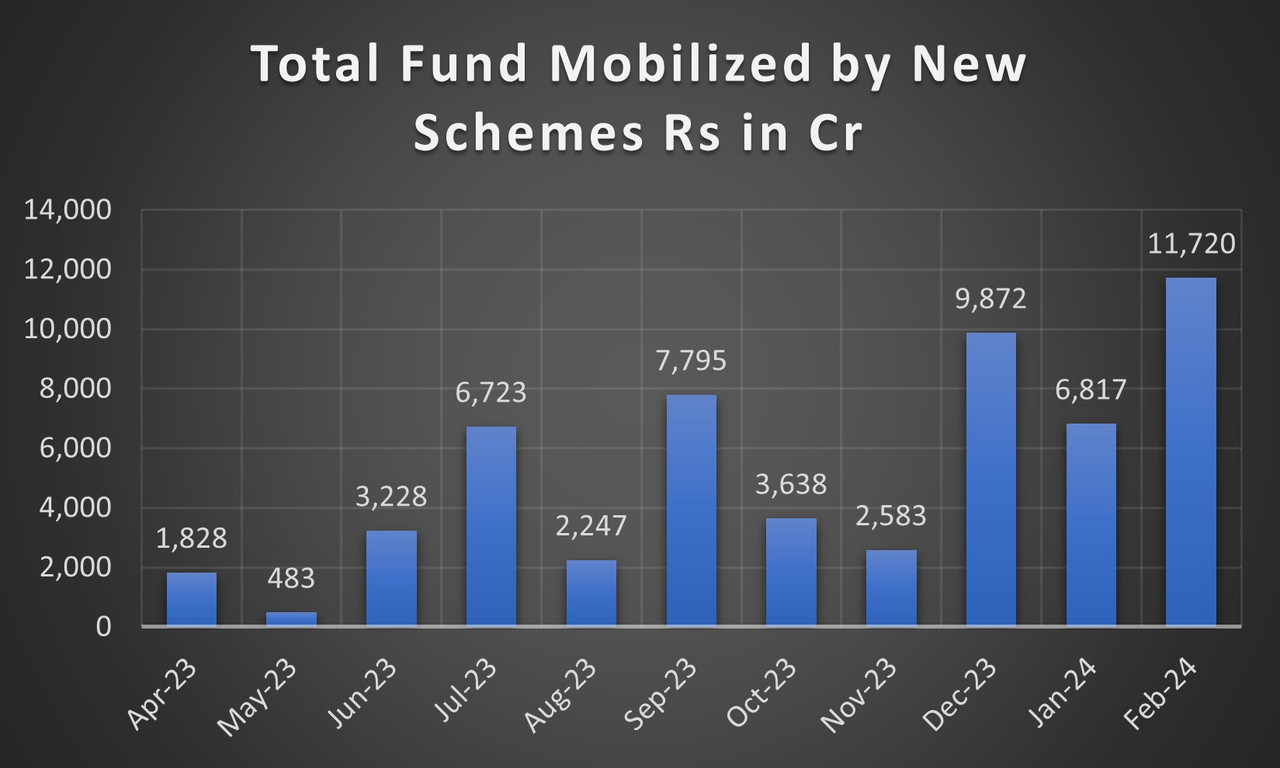

India’s mutual fund offer boom: Record flow of Rs 11,720 crore in NFOs; Sectoral/Thematic inflows jump 134 per cent!

NFOs launched during the month of February, have collected Rs 11,720 crore, which marks a remarkable 72 per cent jump MoM and sets record flows of funds according to the available data.

With AMFI releasing its monthly data for the month of February, there are a couple of interesting points that we thought our readers should know from this data. The first important point is that the inflows in the equity category jumped by approximately 23 per cent MoM. The inflows in February stood at Rs 26,866 crore as against Rs 21,781 crore in the month of January.

So, the key takeaway from the AMFI data is the inflow in sectoral/thematic funds. About Rs 11,263 crore inflows were seen in the month of February as against Rs 4,805 crore in January, marking a staggering 134.4 per cent MoM increase. This sharp jump could be attributed to new schemes launched during February 2024. According to AMFI data, sectoral/thematic funds saw Rs 7,178 crore mobilized with schemes such as Groww Banking & Financial Services Fund, Quant PSU Fund, SBI Energy Opportunities Fund, WhiteOak Capital Banking & Financial Services Fund, and WhiteOak Capital Pharma and Healthcare Fund launched in February 2024.

What’s captivating is the fact that the funds mobilized by the new schemes launched during February, i.e., NFOs launched during the month of February, have collected Rs 11,720 crore, which marks a remarkable 72 per cent jump MoM and sets record flows of funds according to the available data.

|

Month

|

Total Fund Mobilized by New Schemes Rs in Cr

|

|

Apr-23

|

1,828

|

|

May-23

|

483

|

|

Jun-23

|

3,228

|

|

Jul-23

|

6,723

|

|

Aug-23

|

2,247

|

|

Sep-23

|

7,795

|

|

Oct-23

|

3,638

|

|

Nov-23

|

2,583

|

|

Dec-23

|

9,872

|

|

Jan-24

|

6,817

|

|

Feb-24

|

11,720

|

Disclaimer: The article is for informational purposes only and not investment advice.