5 Small Caps that grew profits 10x in 5 years – Are they in your portfolio?

By focusing purely on net profit growth! In this blog, we’ll highlight the top 5 small-cap companies whose profits skyrocketed more than 10x in less than 5 years.

In today’s fast-moving market, with markets hovering near all-time highs and investors chasing small and midcaps, it’s time to take a closer look at which small caps have truly made their investors rich. And how do we measure that? By focusing purely on net profit growth! In this blog, we’ll highlight the top 5 Small-Cap companies whose profits skyrocketed more than 10x in less than 5 years.

Let’s dive into these profit machines!

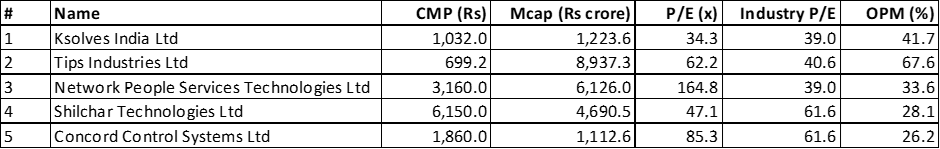

(source: Screener)

1. Ksolves India Ltd

Ksolves India Ltd, founded in 2014, operates in software development, enterprise solutions, consulting, and IT solutions for sectors like Real Estate, E-commerce, Finance, Telecom, and Healthcare. In FY20, Ksolves reported a net profit of Rs 1 crore.

Fast forward to today, and that profit has increased by an astonishing 34 times, hitting Rs 34 crore. This represents a CAGR of 141%! How did they do it? It’s a classic case of operating leverage, where profit grows at a much faster rate than revenue. The company’s revenue grew at 91.68% CAGR over the same period.

2. Tips Industries Ltd

This company, founded in 1996, is in the business of music rights and motion picture production. Tips Industries has mastered the art of profit growth, with its FY19 profit standing at Rs 3 crore, skyrocketing to Rs 127 crore in just 5 years—a 42.3 times jump!

With a profit CAGR of 112%, this small-cap is one of the most lucrative in the industry. Sales grew only at 3.5% CAGR, due to a dip during COVID, but that didn’t stop its profits from booming.

3. Network People Services Technologies Ltd

Network People Services Technologies specializes in software and digital payment solutions for the BFSI (Banking, Financial Services, and Insurance) sector. In FY19, the company posted a net profit of Rs 1 crore, but by FY24, this had grown to Rs 27 crore—a 27 times increase!

The profit CAGR stood at 93%, while revenue grew at a CAGR of 48%. This small cap has proven that fintech is a space to watch.

4. Shilchar Technologies Ltd

Shilchar Technologies manufactures electronics, telecom, and power transformers. This industrial player’s profit grew from Rs 8 crore in FY19 to Rs 92 crore by FY24—a 11.5 times jump in net profit.

The profit CAGR stands at 63%, and revenue grew at 27% CAGR during the same period. Shilchar Technologies is a great example of how traditional industries are still capable of delivering solid returns.

5. Concord Control Systems Ltd

Incorporated in 2011, Concord Control Systems provides electrical machinery to Indian Railways. It saw its profit climb from Rs 1 crore in FY19 to Rs 13 crore by FY24, 13 times increase in just 5 years.

The company achieved a profit CAGR of 67%, while revenue grew at 36% CAGR. A consistent performer, Concord Control Systems proves that focusing on niche industries can lead to significant returns.

Since the profit figures are relatively smaller in absolute terms, the growth tends to appear significantly higher across these companies. But that's the nature of small-cap businesses—they offer immense growth potential.

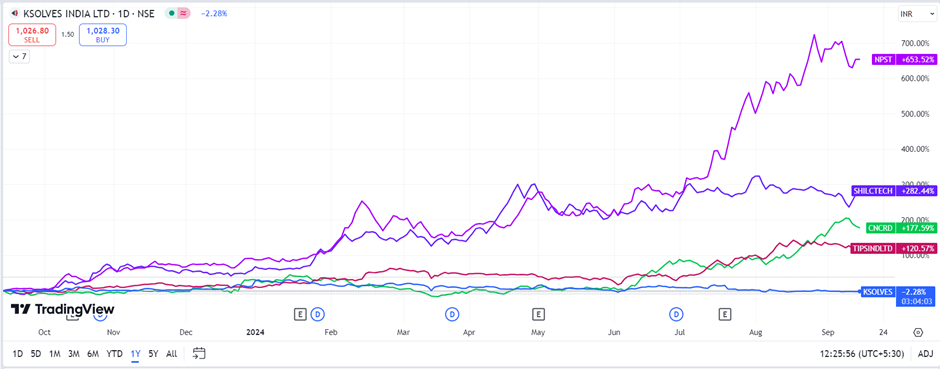

Price Movement (Past 1Y)

Conclusion

These small-cap companies show that strong profit growth can come from diverse sectors—whether it’s IT, entertainment, fintech, or industrial machinery. What they all share in common is their ability to multiply profits by leveraging operating efficiencies, creating value for shareholders. So, as investors continue to chase mid and small caps, keeping an eye on such profit growth stories could lead to future financial success!