Mahadev App Scam: These Stocks Might be Manipulated - Do You Own Any?

The Enforcement Directorate (ED) has swiftly taken action by freezing shares worth Rs 1,100 crore in demat accounts linked to the firm.

In a startling development, the Enforcement Directorate (ED) has unearthed a scandal involving the manipulation of stock prices in the Indian stock market. The scandal, orchestrated by a partner of a Dubai-based firm operating the Mahadev betting app, has sent shockwaves through the financial world. The ED has taken swift action, freezing shares worth Rs 1,100 crore in demat accounts linked to the firm.

The Manipulative Scheme

Hari Shankar Tibrewal, a Kolkata native, stands accused of using proceeds from his illegal gambling and betting business to manipulate stock prices. His modus operandi involved inflating share prices artificially, creating temporary fluctuations, and then withdrawing funds once prices reached a desired level. This scheme allowed Tibrewal to amass significant profits, at the expense of unsuspecting investors.

The ED's Rigorous Investigation

The ED's investigation revealed that Tibrewal had channelled money into the stock market through five foreign entities. The agency is actively recording statements from promoters of listed companies who utilized Tibrewal's services to manipulate stock prices. Furthermore, two associates of the Mahadev group, responsible for its operations in India, have been arrested in connection with the case.

Collusion and Complicity

Tibrewal's scheme thrived on collusion with stockbrokers, intermediaries, and promoters of listed companies. These entities utilized Tibrewal's funds to manipulate share prices, reaping substantial profits for themselves while inflicting losses on small investors. Indian companies under Tibrewal's control held securities worth Rs 580 crore, with foreign entities holding securities worth Rs 606 crore.

Mahadev Group's Controversial Beginnings

The Mahadev Group, founded by Saurabh Chandrakar and Ravi Uppal, along with their partners, first drew attention after Chandrakar's extravagant Rs 200 crore wedding in Dubai. This lavish expenditure raised suspicions and led to further scrutiny of the group's activities.

DSIJ offers a service 'Pop Stock" with recommendations for intraday trading based on research and analysis to help subscribers make healthy profits. If this interests you, then do download the service details pdf here

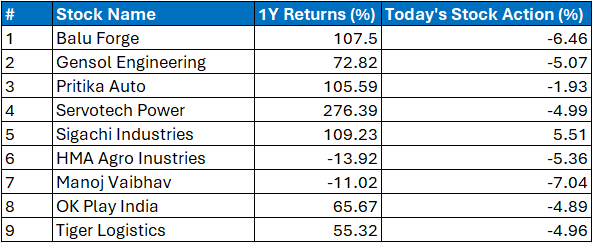

Impacted Stocks and the Aftermath

Several companies, including Balu Forge, Gensol Engineering, Pritika Auto, and Servotech Power, have been affected by the scandal. These stocks are held by entities involved in the manipulation scheme and have experienced significant downturns.

Conclusion

The stock market manipulation scandal involving Hari Shankar Tibrewal and the Mahadev group underscores the importance of transparency and accountability in financial markets. It serves as a stark reminder for investors to remain vigilant and conduct thorough due diligence before investing. The ED's decisive action against such illegal activities sends a clear message that market manipulation will not be tolerated, and those responsible will be held accountable.

Disclaimer: The article is for informational purposes only and not investment advice.