And if India wins the World Cup….

Perfect Pitch to Bat On – The Key is to Identify the Next 'Multibagger' – The Next Virat Kohli of Your Portfolio

Undefeated Warriors: India's World Cup Glory and Financial Dominance

In the ICC Cricket World Cup 2023, India's men's cricket team is scripting an undefeated saga of dominance and skill. A blend of seasoned players and rising stars, they stand on the brink of etching their name as one of the greatest teams in history.

Simultaneously, in the financial arena, India's market indices are soaring. Sensex has climbed 8.54 per cent, and Nifty is up by 9 per cent. Yet, stealing the spotlight are small and midcap index, with Nifty Midcap boasting a 32 per cent return and Nifty Small Cap an extraordinary 36 per cent return. Like the cricket team's unbeatable streak, these indices have dominated the financial arena for six consecutive months (April-September).

This parallel narrative paints a picture of a nation excelling not only in cricket but also in economic resilience. As the World Cup reaches its climax and the financial markets continue their remarkable run, India stands tall, symbolizing unwavering determination and excellence on both the sports field and the economic front. The world watches as India's cricket warriors and financial stars march towards glory, creating a narrative of victory that transcends boundaries.

What if India wins?

Rewriting History: Exploring Past Glories If India Emerges Victorious

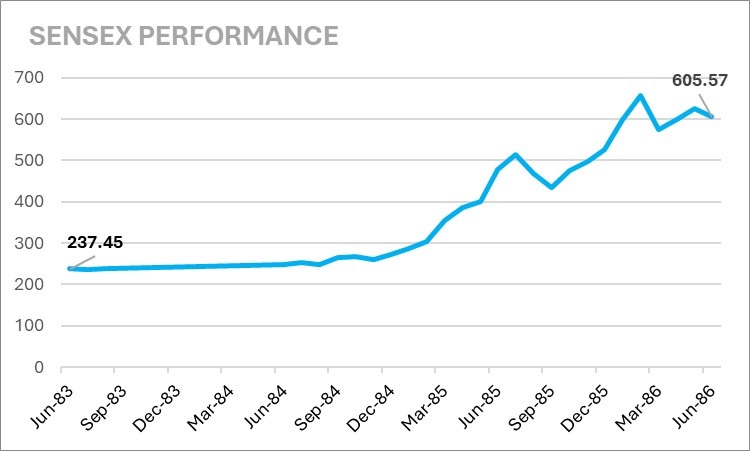

Let's delve into history to explore the impact of India's first World Cup victory in 1983 and 2011 on the stock market. Specifically, we will analyse the Sensex's post-three-year return following this significant event.

In June 1983, the 1983 World Cup concluded, coinciding with a time when the Sensex was in the three-digit range. Interestingly, in the next three years, Sensex delivered a whopping gain of triple-digit – 155 per cent gain (absolute return).

| Returns |

155.00% |

| 1983 |

| SENSEX |

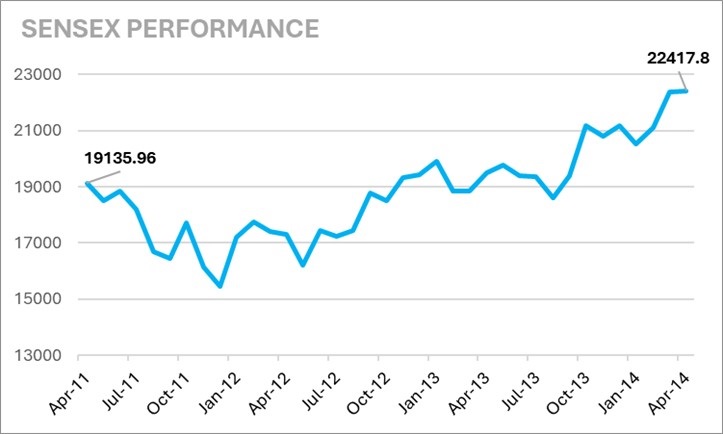

The 2011 World Cup concluded in April. Let's examine the performance of the Sensex in the three years following that event. Sensex advanced 17.2% from April 2011 to April 2014.

| Returns |

17.2% |

| 2011 |

| SENSEX |

Observing historical trends, we note that the market yielded a return of approximately 17.2 per cent in the three years following the 2011 World Cup and a substantial return of around 155 per cent in the three years following the 1983 victory.

Returns shown are in absolute terms.

Analyzing Future Scenarios: Sensex at 65,900 and Historical Trends – Post World Cup Victory

Exploring Potential Futures: Calculating Returns for Sensex at 65,900 with a Base Scenario of 17.2 per cent and Best-Case Scenario of 155 per centOver the Next 3 Years.

Recognizing the potential skepticism around the seemingly optimistic Scenario 2, considering the lower base in the year 1983, we adopt a weighted average approach. Assigning a 70 per cent probability to Scenario 1 (17.2 per cent return) and a 30 per cent probability to Scenario 2 (155 per cent return), the calculated weighted average level stands at 1,04,582!

This makes the Sensex crossing a milestone level of 1,00,000 in the next three years a ‘most likely’ scenario.

And if you think India will win the World Cup, then click here

Perfect Pitch to Bat On – The Key is to Identify the Next 'multibagger' – The Next Virat Kohli of Your Portfolio

The Sensex is poised to cross monumental milestone of 1,00,000, there exists a perfect pitch for savvy investors to discover the next cricketing legends for their portfolios – the next Sachin Tendulkar, the next MS Dhoni, and the next Virat Kohli who can light up your financial innings with multibagger success!

With a bullish outlook propelling the Indian market to unprecedented heights, market participants find themselves at the crease with ample opportunities. It's not just about investing; it's about identifying those stocks that have the potential to be game-changers, much like cricketing icons who redefine the sport.

So, let's don our financial cricketing gear and step onto this exhilarating pitch of opportunities! In a market where milestones are not just numbers but gateways to wealth, it's time to cheer for India's financial innings. Hip Hip Hurray! The stage is set, and the hunt for the next multibagger stars begins – a pursuit that promises excitement, strategy, and the potential to score big in your investment portfolio. Get ready to witness the thrill as we unveil the next champions for your financial team!

Disclaimer: The article is for informational purposes only and not investment advice.